The Wallace Insurance Agency for Dummies

Wiki Article

The 10-Second Trick For The Wallace Insurance Agency

Table of ContentsSome Known Factual Statements About The Wallace Insurance Agency The Wallace Insurance Agency Things To Know Before You BuyGetting The The Wallace Insurance Agency To WorkThe Wallace Insurance Agency Things To Know Before You Get ThisThe Best Strategy To Use For The Wallace Insurance AgencyNot known Details About The Wallace Insurance Agency Getting The The Wallace Insurance Agency To WorkThe Only Guide to The Wallace Insurance Agency

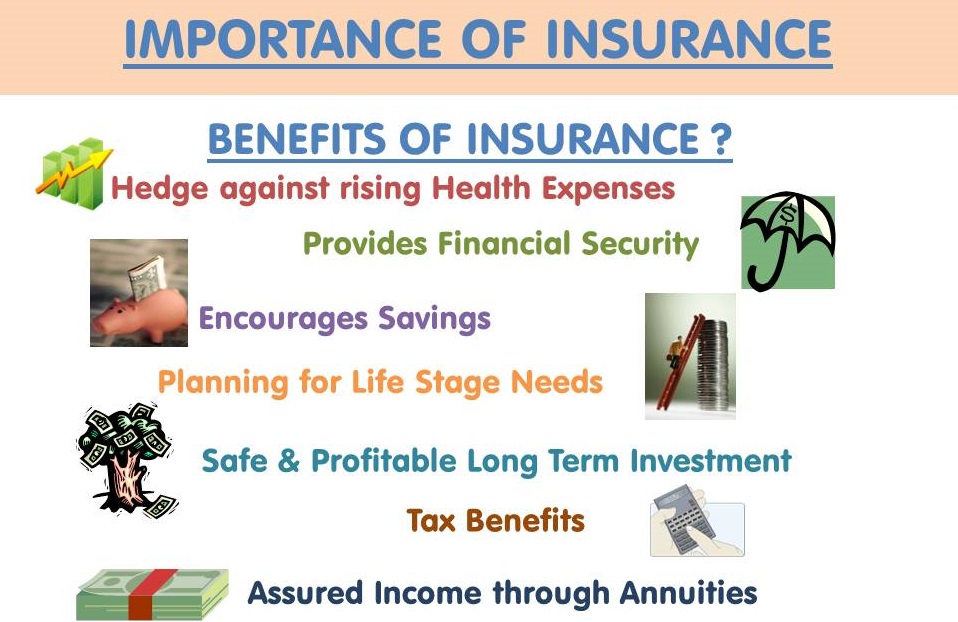

These strategies likewise supply some protection component, to help make sure that your recipient gets monetary compensation must the unfortunate occur throughout the tenure of the policy. Where should you begin? The easiest method is to begin thinking of your concerns and demands in life. Here are some concerns to obtain you began: Are you trying to find greater hospitalisation coverage? Are you concentrated on your household's health? Are you attempting to save a good amount for your youngster's education and learning needs? Many people start with among these:: Versus a background of rising medical and hospitalisation expenses, you could desire larger, and higher protection for clinical expenditures.: This is for the times when you're injured. As an example, ankle joint strains, back strains, or if you're torn down by a rogue e-scooter motorcyclist. There are additionally kid-specific plans that cover play area injuries and diseases such as Hand, Foot and Mouth Disease (HFMD).: Whole Life insurance coverage covers you forever, or typically up to age 99. https://parkbench.com/directory/wallaceagency1.

The Wallace Insurance Agency Things To Know Before You Buy

Depending upon your coverage strategy, you get a lump sum pay-out if you are permanently disabled or critically ill, or your loved ones get it if you pass away.: Term insurance policy gives protection for a pre-set period of time, e - Insurance policy. g. 10, 15, two decades. Because of the shorter protection duration and the absence of cash value, premiums are normally less than life plansWhen it grows, you will certainly obtain a swelling sum pay-out. Cash for your retired life or children's education, check. There are 4 common sorts of endowment strategies:: A plan that lasts regarding ten years, and supplies annual money benefits on top of a lump-sum amount when it matures. It normally consists of insurance policy coverage against Overall and Long-term Special needs, and fatality.

The Only Guide to The Wallace Insurance Agency

You can choose to time the payment at the age when your child mosts likely to university.: This supplies you with a regular monthly income when you retire, generally on top of insurance coverage.: This is a method of saving for temporary objectives or to make your cash work harder versus the forces of rising cost of living.

The Wallace Insurance Agency Can Be Fun For Anyone

While obtaining different plans will provide you more detailed coverage, being excessively safeguarded isn't a good idea either. To stay clear of unwanted monetary stress, contrast the plans that you have versus this list (Life insurance). And if you're still unclear regarding what you'll require, how much, or the kind of insurance to obtain, get in touch with a monetary expertInsurance policy is a lasting dedication. Constantly be sensible when deciding on a plan, as switching or terminating a plan prematurely typically does not produce monetary benefits.

The Single Strategy To Use For The Wallace Insurance Agency

The best part is, it's fuss-free we automatically work out your cash flows and provide cash pointers. This write-up is indicated for information just and must not be trusted as financial guidance. Before making any kind of decision to buy, market or hold any type of investment or insurance policy product, you should inquire from a financial consultant regarding its viability.Invest just if you comprehend and can monitor your financial investment. Diversify your financial investments and prevent spending a big section of your money in a solitary product provider.

Fascination About The Wallace Insurance Agency

Life insurance policy is not constantly the most comfortable based on discuss. However much like home and vehicle insurance, life insurance policy is necessary to you and your family's monetary safety and security. Parents and functioning grownups generally require a kind of life insurance policy plan. To help, let's explore life insurance policy in extra detail, how it works, what value it may supply to you, and exactly how Financial institution Midwest can aid you locate the right policy.

It will help your family repay debt, receive revenue, and get to major monetary goals (like university tuition) in the occasion you're not right here. A life insurance policy is fundamental to planning these economic factors to consider. For paying a regular monthly premium, you can get a set quantity of insurance policy coverage.

The Greatest Guide To The Wallace Insurance Agency

Life insurance is appropriate for nearly everyone, also if you're young. People article in their 20s, 30s and also 40s often forget life insurance coverage - https://myanimelist.net/profile/wallaceagency1. For one, it requires resolving an uneasy inquiry. Numerous younger individuals additionally assume a plan merely isn't appropriate for them given their age and family circumstances. Opening up a plan when you're young and healthy and balanced can be a clever choice.The more time it takes to open a policy, the even more risk you face that an unexpected occasion could leave your family without protection or monetary assistance. Depending upon where you're at in your life, it is necessary to understand exactly which type of life insurance is best for you or if you require any kind of in all.

The Facts About The Wallace Insurance Agency Uncovered

For example, a home owner with 25 years continuing to be on their mortgage might get a policy of the exact same length. Or allow's say you're 30 and plan to have kids soon. In that case, enrolling in a 30-year policy would lock in your costs for the following three decades.

Report this wiki page